Your PSSP contributions are deducted from your pay each payday by your employer. Your employer matches your contributions by contributing an equal amount to the Plan. These contributions are invested to grow the pension fund, helping to pay for the future pension benefits of its members. While contributions are important, your pension is based on your years of pensionable service and pensionable earnings, not the amount you contribute.

How much do I contribute?

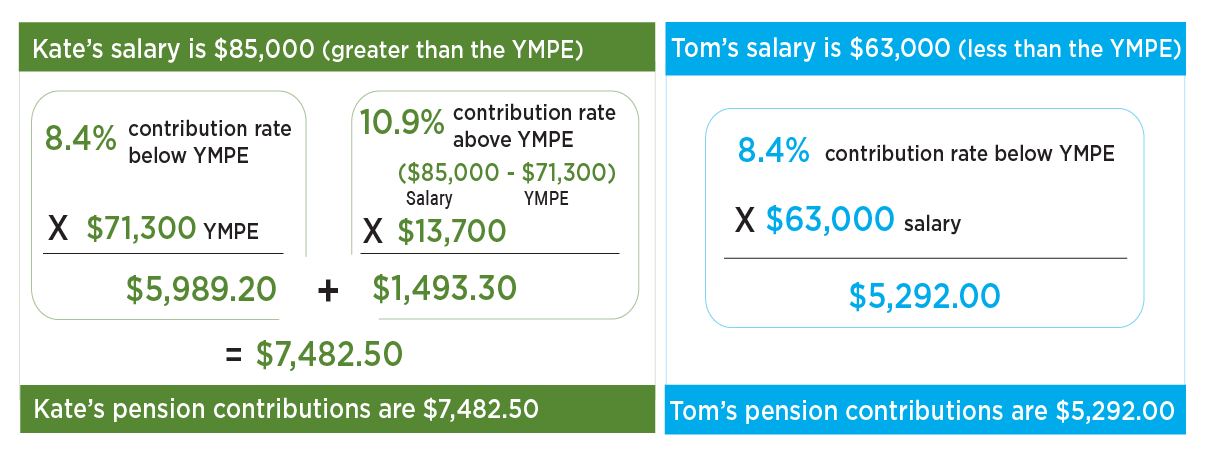

To view what you contribute to the Plan, check your pay stub. There are two rates of contribution.

- 8.4% of pensionable earnings up to the year’s maximum pensionable earnings (YMPE), and

- 10.9% of pensionable earnings above the YMPE.

How much does my employer contribute?

Your employer matches your contributions.

- 8.4% of pensionable earnings up to the YMPE, and

- 10.9% of pensionable earnings above the YMPE

What is the YMPE?

The YMPE is an important term to understand when it comes to calculating your pension. It is set by the federal government and is used in determining the reduction to your pension at age 65. It changes every January 1 to reflect increases in the average wage.

You cannot contribute to the Plan after you reach age 71. This is the maximum age that the Income Tax Act (ITA) permits pension contributions to be made. The ITA rule states, "a member's pension contributions must stop by November 30th in the year in which they turn age 71 and they must start receiving their pension no later than December 1st in the same year". You can continue to work with a PSSP employer, but you will be a retired member of the Plan.

Image

35-years of Pensionable Service* Cap: On April 1, 2026, this rule will change and the 35-year cap on pensionable service will be eliminated. This means:

* Your Pensionable Service is equal to the number of years you worked and made pension contributions; this includes any purchases of service and reciprocal transfers into the Plan. |

How Your Pension Contributions Are Calculated: Examples Using the YMPE for 2025 ($71,300)