The annual pension you will receive in retirement is calculated using a pre-determined formula that is based on your earnings and how much service you have in the Plan.

To calculate your annual pension, we use:

- Your 5-year highest average salary (HAS). This is your average annual salary for the five years of your career during which your salary was at its highest.

- The average Year’s Maximum Pensionable Earnings (avg. YMPE). The avg. YMPE is based on the same period as your HAS.

- The YMPE is set by the federal government and is used in determining the reduction to your pension at age 65. It changes every January 1 to reflect increases in the average wage.

- The YMPE is set by the federal government and is used in determining the reduction to your pension at age 65. It changes every January 1 to reflect increases in the average wage.

- Your pensionable service, is the number of pensionable years you have earned.

- It is equal to the number of years you worked and made pension contributions; this includes any purchases of service and reciprocal transfers into the Plan. If you worked part-time, your pensionable service would be pro-rated accordingly. For example, if you worked 10 years at 50% part-time, your pensionable service would be 5 years.

Image

35-years of Pensionable Service Cap: On April 1, 2026, this rule will change and the 35 year cap on pensionable service will be eliminated. This means: If you reach 35 years of pensionable service on or after April 1, 2026, you will continue to make pension contributions and earn pensionable service for as long as you are an active Plan member. If you reach 35 years of pensionable service prior to April 1, 2026, and you continue to be an active Plan member following April 1, 2026, you will begin paying pension contributions and earning pensionable service again. You will have the option to purchase service for the period when you were not contributing to the Plan. |

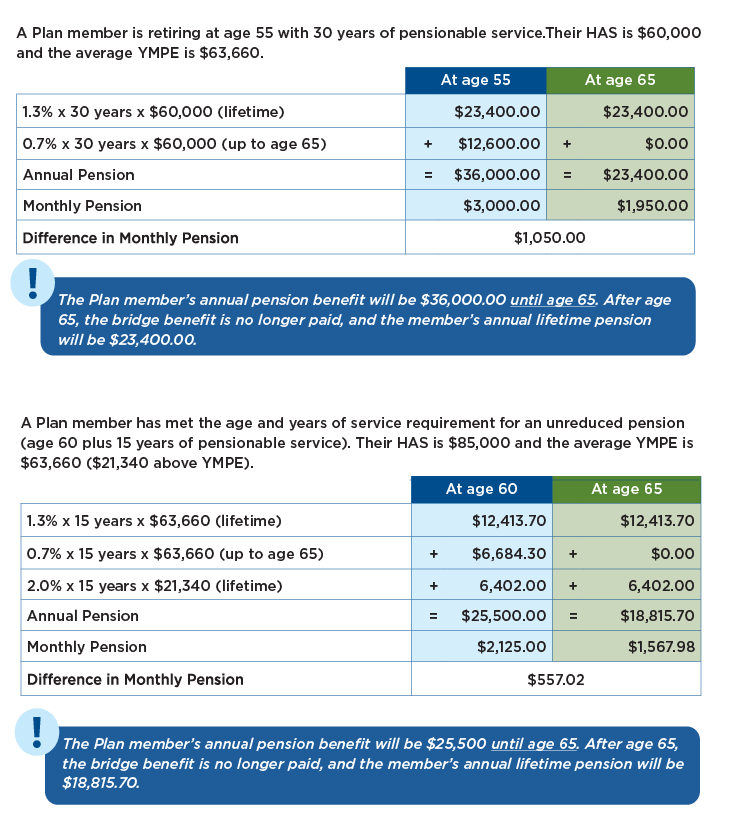

Your pension benefit is made up of two components, your lifetime pension and your bridge benefit.

Your lifetime pension is calculated as 1.3% of your highest average salary (HAS), multiplied by your years of pensionable service, and is payable from the date you start receiving your pension until death. If your HAS is greater than the average YMPE, the portion of your salary above the YMPE is calculated at 2.0%.

Your bridge benefit is calculated as 0.7% of your HAS, up to the average YMPE, multiplied by your years of pensionable service, and is payable from the date you start receiving your pension until age 65.

- The bridge benefit is designed to supplement your income until unreduced benefits are payable from CPP at age 65. If you retire before age 65 and decide to begin receiving a reduced CPP benefit, you will still receive the bridge benefit until age 65.

Unreduced Pension Calculation Examples: